The main challenges of real-estate syndicators are creating a system to raise capital consistently, finding deals, and automating back-office work.

While most software probably can’t fully help syndicators find deals, it can make raising money easier and automate most of the paperwork. In this post, we reviewed nine leading real-estate syndication software and compiled an infographic on how to choose one that offers the best value for its price:

- Juniper Square

- IMS

- Update Capital

- AppFolio

- Investor Deal Room

- InvestNext

- GroundBreaker

- Syndication Pro

- Cash Flow Portal

1. Pricing structure

We can divide real-estate syndication software into four main price categories:

- Premium: $1200 – $2000 a month. Juniper Square and IMS belong to this category.

- Mid-market: $500-$700 a month with Update Capital, AppFolio, and Investor Deal Room in this price range.

- Economy: $50-$200 a month with software like InvestNext, GroundBreaker, and Syndication Pro in this category

- Value: $100-$200 a month. Cash Flow Portal is occupying this niche.

2. Minimum length of the contract

Knowing contract lengths is vital because once you commit to a one or two-year contract and upfront payment of a few thousand USD, it will be challenging to terminate this agreement without losing much of your money. Contract lengths also play a role in product development. Any SaaS company’s goal is to reduce churn rate, increase customer lifetime value and ARR. When the entire user base is committed to at least one year of software usage, the company can get complacent and dedicate fewer resources to product development, innovation, and new features.

Here is how contracts lengths compare:

- Long term. Juniper Square, IMS, Investor Deal Room, AppFolio, GroundBreaker

- Short term. Syndication Pro and Cash Flow Portal.

3. Free Trial

Free trial means that the company is focused on customers and wants to ensure customer-product fit before charging you any money.

Currently, only Cash Flow Portal offers a commitment-free trial with no credit card or demo required to try the tool for 14 days. The trial can be extended to 30 days upon request. Syndication Pro offers a free trial too. However, there is no clear sign-up form to access it, as you need to book a demo call with their sales rep before they send you a trial link.

4. Longevity in the market

IMS was the first software of its kind in the market, followed by Juniper Square. The youngest kids on the block are Syndication Pro (released to sponsors in 2018) and Cash Flow Portal (released in 2020)

5. E-signature

Most software reviewed in this post use DocuSign integration. There are pros and cons to DocuSign, with cons being challenges switching to another provider, complex configurations, a lot of manual work to set up sections, etc.

- IMS is currently switching to an alternative to DocuSign.

- Juniper Square and Investor Deal Room use Docusign. The drawback of Docusign is that Docusign cannot be embedded on the main website and investors read their email to get dedicated Docusign documents. The advantage is Docusign is most well-known.

- Syndication Pro uses HelloSign and cannot automatically fill out metadata if the profiles contain that data.

- Cash Flow Portal also uses HelloSign and allows pre-filling of documents based on profiles’ metadata.

6. Passive investor interface and user experience

All the tools reviewed in this post, except Cash Flow Portal, were initially built as white label investment management software to power up syndicators’ websites. As a result, passive investor experience can be frustrating. If investors need to view six deals, they will have six different logins and sign in/sign out of six different sites. Another roadblock is that all these tools require investors to get approvals from syndicators to sign up to the portal.

Cash Flow Portal has a seamless investor sign-up experience with all deals available on one platform with one single login.

7. Ease of use for syndicators

Creating deals is probably the most used feature of real-estate syndication software. The easier it is to create deals, the more time syndicators save doing manual work.

IMS and Juniper square deals creation feature requires a bit of practice and effort to master due to their complexity.

Syndication pro has a user-friendly and simple way to create deals. The downsides are that you can’t add equity classes, and there is no cap table. As a result, you cannot run fancy waterfall distributions, and distributions are all manual.

Cash Flow Portal “create deal” feature is as simple as Syndication pro’s with the addition of equity classes and cap tables. It is also set up to run waterfall distributions.

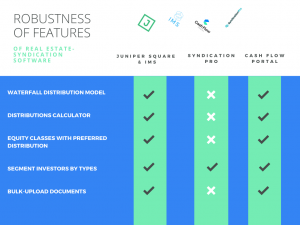

8. Robustness of features

This chart explains it all:

9. Ecosystem vs. white-labeled tool.

All the software mentioned in this post, except Cash Flow Portal, is white-labeled. As we mentioned above, it affects passive investor experience and makes deals hard to find.

Cash Flow Portal is the only platform aiming to recreate an “Airbnb-like” experience where passive investors can view all the deals on a single website. Moreover, syndicators can switch between a passive investor and a syndicator view with a single click using the same account.

Syndicators are protective of their investors, because their investors are their biggest asset. In all platforms, the investors are sandboxed so there is no worrying that a syndicator’s investors get exposed to other syndicators.

10. Engineering Teams

A full-time engineering team is essential for a good SaaS product because it allows for flexibility when launching new features, quick bug fixing, and better customer service. We read a few Capterra reviews where users explicitly mentioned how lack of IT specialists hinders product development.

Currently, Juniper Square and IMS have small engineering teams (remote for Juniper Square). Their sales and marketing teams are much bigger, which means that they are sales-focused rather than product-focused.

Syndication Pro outsources its engineering team to India, which partially explains the affordability of software.

Cash Flow Portal has its full-time engineering team with a Silicon Valley background.

11. Founder-product fit

While successful real-estate syndicators founded Syndication Pro and Cash Flow Portal, IMS & Juniper square’s founders are engineers and sales professionals. Why is it important? Because syndicators know the business inside out, understand users’ needs and develop a product tailored for real-estate syndication business.

Author’s bio:

Perry Zheng

CEO & Founder

www.cashflowportal.com

https://www.linkedin.com/in/perryzheng/

Perry Zheng is a founder and CEO of Cash Flow Portal, real-estate syndication software. It is robust investment operations software and a powerful tool for raising capital that already helped syndicators raise $100MM+. Perry is also a full-time engineering manager at Lyft. He worked at Twitter and Amazon before that.